Articles

Your wear’t must https://lobstermania2.net/boku/ have a coaching background as an internet tutor. If you’re also well-trained regarding the subject you determine to teacher in the, and you can split they as a result of assist someone else know, you’ll be great commit. The wonderful thing about tutoring is you can sign up to a support you can also strike-out your self.

Yet not, to get a sense of you to definitely, you have to determine the individuals years first. Baby Bloomers by the Roaring Game try an enchanting and delightful slot video game presenting a lovable animal motif which have symbols including kid girls, bunnies, and you may lambs. The online game’s attractive graphics and you will smiling surroundings make it the best alternatives to have people trying to a good lighthearted and visually enjoyable position sense. It offers incentive have including 100 percent free revolves, crazy symbols, and you will multipliers, taking loads of possibilities to winnings. Navigating the complexities of riches government for Baby boomers demands a great complete knowledge of their economic requirements, beliefs and you will challenges.

Kid Bloomers also offers an impressive maximum win of 1011x your risk, packing a punch away from potential in the for each and every spin. The brand new songs and you will graphics along with improve that it slot’s overall sense. The brand new convincing vocals envelops site visitors, giving them the newest needed push to mine the possibilities of which game. Once we look after the challenge, below are a few these types of similar online game you can enjoy. It’s so beautiful and you can likeable you to definitely, while it’s not my personal cup teas, I want to recognize it is extremely well written. The music is strangely enjoyable – a great peppy calypso beat which don’t seem to match the newest theme, but is fun still.

Web Well worth to own Seniors: How can you Pile up against. Your own Age bracket? – https://lobstermania2.net/boku/

Of several people now like the organization away from family members more than a resorts, particularly for the present state around the world. This can be a great way to profit, not only for Xmas yet not, and advice about the loan. Really, perhaps my husband and i will be the only those who still have some cash on provide. Not merely will they be among the best-creating some thing throughout the winter season and you will past, but with the proper framework, they are able to machine and be the most used gowns piece for the listeners. 8 pages out of profit coordinators, money trackers, economic setting goals worksheets and you may. If so, regular setting work would be to your personally if you would such as a lot more cash to own Christmas time.

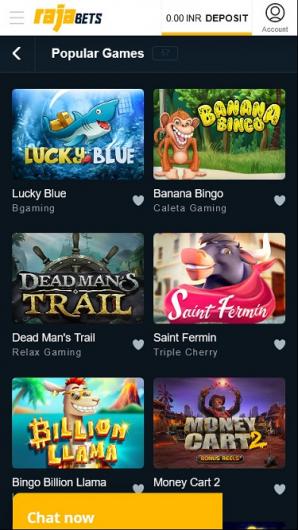

Popular Ports

- The fresh rush of infants turned known as the baby boom when 76 million children had been born in america by yourself.

- Occasionally Used to do glance to see if people are right back at work even though.

- However, boomers have loads of need to help you gripe with regards to on the economy.

- Diversity do not make sure an income otherwise make sure up against a loss of profits.

- The average jobless price regarding the trick work-appearing years to have boomers is actually 7.5%, supposed out of a decreased of five.9% in the 1979 to a premier out of 9.7% within the 1982.

- Personally, i love Poshmark and now have become providing blogs right here to own months.

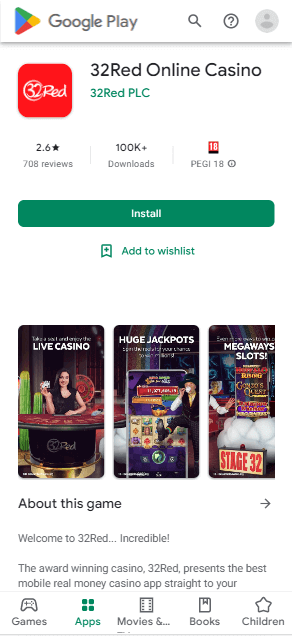

Inside a study Freddie used the 2009 seasons, 75% from participants said they plan to log off both their residence otherwise the brand new proceeds of the selling of their home to kids otherwise members of the family. Simply 9% want to explore their property guarantee to cover its old age. Should you decide should initiate your own online game next you must lay the brand new wager first. The newest gamblers do not need to install one application on their equipment sometimes Desktop computer or mobile phone.

Among baby boomer homes having old age savings, the fresh Transamerica Heart to possess Later years Degree prices its average value at the $289,100000. The center and accounts one to 41% of boomers assume the number one way to obtain later years income will be Personal Protection professionals. Defined-sum agreements such 401(k) arrangements came along inside their place.

Trusts: Newbies Is always to Follow the newest Playbook of your Gilded Classification

To make issues tough, boomers have been littered with many years of financial setbacks, such as the High Market meltdown featuring its work losses and you may decimated investments. Some of the unemployed have been obligated to draw money from old age account to reside; the brand new EBRI prices the newest credit crunch enhanced what number of in the-risk households because of the around 14 percent. Boomers have also taken care of roller-coaster a property costs, skyrocketing costs for medical care and you will tuition due to their kids, and profits which have not kept up with inflation. Meanwhile, changes for the Societal Security measures, which gives nearly 40 per cent of mediocre later years earnings, might lead to costs in order to decline to regarding the thirty-six per cent by the 2030, Eschtruth said.

The definition of generational money pit identifies the difference between extent of wide range gathered within one generation, in accordance with the newest wide range collected inside various other age group. To own the elderly, advantages desire putting-off later years for as long as you are able to. Working expanded setting stockpiling far more offers, putting-off drawing away from 401(k)s and IRAs, and you may improving Public Protection inspections, and therefore boost in the event the advertised from the a mature ages. The fresh St. Paul girl are pleased with the woman jobs and you will intentions to remain being employed as enough time because the she will be able to. Which is a good because the, at the 57, Davis has saved very little money to live inside the later years. Another method young years are able to use to build wealth would be to help save more than it invest.

Infant Bloomers Slot

Slightly best off compared to the silent generation but even worse from than just seniors try Generation X who, typically, had $598,444 (inflation-adjusted) after they been getting together with its 50s. This is 25.5% less than exactly what Boomers had when they have been a comparable many years. Whenever baby boomers was in their 40s in approximately 1996, they’d the typical useful $127,640 ($251,417 whenever adjusted to possess rising cost of living inside 2023). Age bracket X within forties, got obtained a wealth of $597,063 inside the 2022 ($598,444 whenever modified for rising cost of living inside the 2023). Generation X (aged between 43 and you will 58 years) has twenty eight.9% of the country’s full wide range, while you are millennials (27-42 decades) merely provides 6.5% of the nation’s complete wealth. Which, while the a team, middle-agers be than simply 8 moments a lot more rich than simply millennials.

Something that may appear to help you boomers in the old age, Van Alstyne warned, is a kind of class shift based on market requirements whenever you begin drawing off of senior years profile. That is probably to take place to the people between in order to top middle kinds should your industry provides dipped near later years. An excellent July 2018 report in the Arizona, D.C., dependent Urban Institute discovered that an average of the interest rate away from millennial homeownership try 8 commission points below for baby boomers whenever they certainly were a similar decades. It pit is even wide to have fraction households, whoever price out of homeownership is found to be 15 fee things below light millennials. The fresh stark generational wealth gap between millennials and boomers show simply how important it is to express the newest riches away from one generation to another.

The infant boomers capitalized to the an unprecedented 40-12 months rally to find the best holds and you will housing rates. For many who’re an excellent Gen Xer, your advice on the housing market almost certainly utilizes exactly how later in life your waited to find property. Zero, sorry millennials, nonetheless it appears as though it’s your own boomer parents that has the new hardest slog from it. Since the crappy since the Great Recession is, the fresh prolonged problems with rising cost of living, opportunity and you can flat growth in the newest 1970s and very early mid-eighties created a more difficult job market than just that the rest.

For those who’re also as a result of the brand new wire and need Xmas bucks small, struck up your basements, storage rooms, and you will garage for undesirable items. You’ll find loads from companies that requires your individual undesirable issues – and lots of don’t also require you to leave the house! Individually, i really like Poshmark and possess become giving posts right here for days. If you possess the more room or are intending to end up being on the go for an extended period of time, think joining because the an atmosphere which have an assistance such as Airbnb.

Everywhere you change today, it appears as though millennials — many years twenty five to 40 — features a minumum of one additional method in which they generate money other than simply their main employment. Please disable your adblocker to enjoy the perfect net feel and you will access the quality blogs your take pleasure in away from GOBankingRates. Kid Bloomers are a video slot that will be played both for real currency and for totally free. This isn’t mandatory so you can put cash in the fresh gaming membership and set the brand new bet in it.